When someone passes away, the grieving process begins for the Decedent’s loved ones. Then the time comes for the loved ones to determine whether a Probate will be required, and this step is simply just one element in the reckoning that impacts an Estate or Trust administration. Taxes also play a vibrant role in the administration process. The key takeaway for the income tax return for an Estate or Trust is the word “Fiduciary.”

Fiduciary is a term associated with trust and due diligence. A Fiduciary is someone who must put the best interest of the person(s) they are representing ahead of their own. Additionally, a fiduciary must act with loyalty, honesty, and be trustworthy.

A fiduciary serving in the role of Personal Representative or Trustee is required to attend to and file all necessary tax returns for an Estate and Trust. These returns may include the following, depending on the circumstances of the Estate; or more specifically, the assets comprising the Estate:

- A Final Form 1040 Individual Income Tax Return, for the period covering January 1 through the date of death;

- Gift Tax Return (Form 709) if the Decedent made gifts during their lifetime and in the year of death over the gift tax exemption amount (2023 Exemption is $17,000). Payment of $17,000 per individual is tax-free, meaning no gift tax return is required to be filed;

- Estate Tax Returns (Form 706) with Federal Exemption of $12.92 Million and MN Revenue Exemption is $3 Million for 2023; and

- Fiduciary Income Tax Return for Estates and Trusts -Form 1041.

Here are Top 10 Guides or tips for managing the Fiduciary Income Tax Returns:

In general, the Fiduciary of a Decedent’s Estate files Form 1041 to report the income, deductions, gains, losses, etc., of the Estate and Trust. The fiduciary must determine whether income should be held for future discretionary distributions or distributed currently to beneficiaries, and, ultimately, calculating any income tax liability that may be owed by the Estate or Trust.

The preparation of the Fiduciary Income Tax Returns requires an understanding and management of all the ins and outs of the information to be reported on these returns. In no particular order, here are the Top 10 Guides for preparing and filing Fiduciary Income Tax Returns for Trusts and Estates:

Guide #1

Income Exemption Level: Trusts and Estates are entitled to a $600 exemption. A return is required to be filed if the Trust or Estate earns $600 or more of income.

Guide #2

Tax Reporting Period: The reporting period for the Fiduciary Income Tax Returns may be on a calendar year ending December 31st, or on a fiscal year period, which at times, is the more commonly used tax reporting period for Trusts and Estates. The fiscal year period ends on the last day of the month before the Decedent’s date of death and is due to be filed four and a half months after the close of the tax year.

For Example: The Decedent dies on March 26, 2023. The first fiscal year period will cover March 26, 2023 (DOD) through February 28, 2024, with a filing deadline of June 15, 2024.

Guide #3

Income to be Reported: The income to be reported on Fiduciary Income Tax Returns for Trusts and Estates includes, and is not limited to, the following:

Interest – from bank or investment accounts; notes or promissory loans, U.S. Treasury Savings Bonds (typically reported on a Form 1099 or Schedule K-1);

Dividends – Ordinary and Qualified dividends also reported on a Form 1099-DIV;

Business Income or Loss – Report the income and expenses typically reported on a Form 1040 (Schedule C) Profit or Loss from Business;

Capital Gains or Losses – Stock or Bonds sold during the tax period of the Trust or Estate are typically reported on a Form 1099;

Ordinary Gain or Loss – Gains or losses from the sale of property, i.e. business property, real property, etc.; and

Other Income – Other income would also be reported on Form 1099, such as distributions from a retirement account or IRA/ Annuity as shown on Form 1099-Rs.

Practice Tip: Review the inventory of assets held in the Trust or Estate or prior year tax returns for the Decedent. This helps the Fiduciary identify the income sources and to look for the various Form 1099’s or Schedule K1s for the Fiduciary Income Tax Returns.

Guide #4

Allowable Deductions: The most common deductions reported on Fiduciary Income Tax Returns for Trusts and Estates includes the administration fees and expenses, such as attorney, accountant and tax preparer fees, administration costs that would not have been incurred if the property were not held in the Estate and so on. Other allowable deductions may include appraisal fee, or fiduciary fees that are established under the reasonableness standard.

Guide #5

Deductions Not Allowed: The key is to know what is not deductible on the Fiduciary Income Tax Return, so determining which of the following deductions would be best utilized on the other tax returns discussed above. Those deductions not allowed on Form 1041’s include:

- Funeral expenses;

- Medical and Dental expenses of the Decedent;

- Personal Interest (credit cards, etc.); and

- Expenses attributable to tax-exempt income, such as brokerage commissions for tax-exempt bonds.

Guide #6

Income Distribution Deduction: A Trust or Estate calculates gross income in the same manner as individuals do and most deductions and credits allowed to individuals are also allowed for a Trust and Estate. However, there is one main distinction. Trusts and Estates are allowed an income distribution deduction for distributions made to beneficiaries during the administration.

Schedule B of Form 1041 is used to calculate the income distribution deduction that determines the amount of any distributions to be taxed to the beneficiaries.

A Trust or Estate is often referred to as a pass-through entity, which requires its own tax identification number. The beneficiary, and not the Trust or Estate, pays the income tax on their distributive share of income, which is reported on a Schedule K-1 (Form 1041).

The key point is that the Fiduciary must determine the type of accounting income of the Trust or Estate by reviewing the terms and provisions under a Trust Instrument or a Will. Let the Estate Planning documents be your guide.

Guide #7

Special Elections for Trusts and Estates: The 645-Election is for treating the Trust as part of the Estate, thereby filing only one Fiduciary Income Tax Return for Trusts and Estates, rather than one for each entity. This saves time and money for the fiduciary and the beneficiaries of an Estate or Trust.

The 65-Day Rule is another gem of an election. If a distribution is made within the first 65 days of the end of the tax period, for instance on a calendar year with the year-end being December 31st, i.e., distributing by March 5th, the distribution is treated as a deduction in the prior tax year.

Guide #8

Obtaining a Minnesota Tax ID: If you plan to electronically file your Fiduciary Income Tax Returns for Trusts and Estate, the Minnesota Department of Revenue requires that a Minnesota ID Number be obtained for the Trust or Estate. The Minnesota Application to obtain a Minnesota ID can be completed online and the information needed pertain to the Estate or Trust:

- Name and Address of the Fiduciary (Personal Representative or Trustee)

- The Employer Identification Number obtained for the Estate or Trust

- The NAICS Code for Estates and Trusts is 525920

Guide #9

Filing an Extension: Oftentimes the Fiduciary will need more time to file or pay fiduciary income taxes for Estates and Trusts. The Federal Form 1041 has an automatic extension of time to file, which is 5 ½ months and is completed by filing Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. However, if there is any fiduciary income tax liability owing, at least 90% of estimated taxes must be paid before the original filing deadline, or late payment interest and penalties will be applied.

For the Minnesota Department of Revenue, the same rules apply regarding extension of time to file and making payment of any income tax due, if the Federal Extension of time to file is approved.

Guide #10

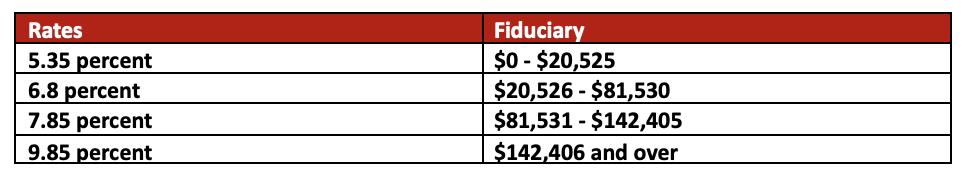

Minnesota 2022 Fiduciary Tax Rates and Income Brackets (Minn. Stat. § 290.06):